Credit Hold: In the Customer Standard form when the 'Credit Hold' check box is checked, all orders for the customer will go on Credit Check Failure hold without going through the credit check logic.

Credit Check: In Customer Standard form when the Credit Check check box is checked, the Credit Checking program applies the Credit Check Failure hold after checking the credit worthiness of the customer and applies the hold only from booking onwards.

The Credit Check Rule can be used at the following points in the Order Life Cycle. The same credit check rule, or different credit check rules, can be defined for all four (4) of these phases:

1. Ordering

2. Picking

3. Packing

4. Shipping

Sales Order Level Hold: Order level credit check uses exclusively header level information ignoring different bill-to sites detailed at line level. Order level credit check is performed for the header 'Bill to Site'.

Sales Order Line Level Hold: Line level credit check uses data at the sales order line level. When an order line fails credit check, any remaining lines grouped with the same 'Bill to Site' are also placed on hold.

Credit Check Steps:

a) Credit Limit Setup: At Customer Acount/Bill-To-Site Profiles level, check the Apply hold checkbox and give the profile amounts in the respective currency.

(N) Order Management -> Customers -> Standard

b) Credit Rules Setup: Create a credit check rule at Sales Order level because we want to apply Credit Check Rule at Header Level.

(N) Order Management -> Setup -> Rules -> Credit

c) Transaction Type Setup: Here, we need to enter the Credit Check Rule at Order Level. Either create a New Transaction Type or open the existing Transaction Type to apply the Credit Rule information.

(N) Order Management -> Setup -> Transaction Types -> Define

d) Payment Terms Setup: Enable “Credit Check” check box on the payment terms that you are using.

(N) Order Management -> Setup -> Orders -> Payment Terms

Now, create a New Sales Order and select the same Customer, Payment Terms & Transaction Type which we have use in Credit Check Setup.

If the Sales Order amount is greater than the amount which we have defined for that Customer then a Hold will be applied at SO Header Level.

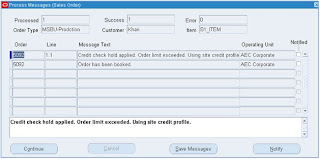

Once you BOOK the Order or add a New Sales Order Line to an existing Booked Sales Order then you will get a message saying that Hold is applied at Header Level because of Credit Check Setup.

You cannot Pick Release any Sales Order Line unless or until you remove the Sales Order Header Hold manually.